Mercer's Investment Beliefs

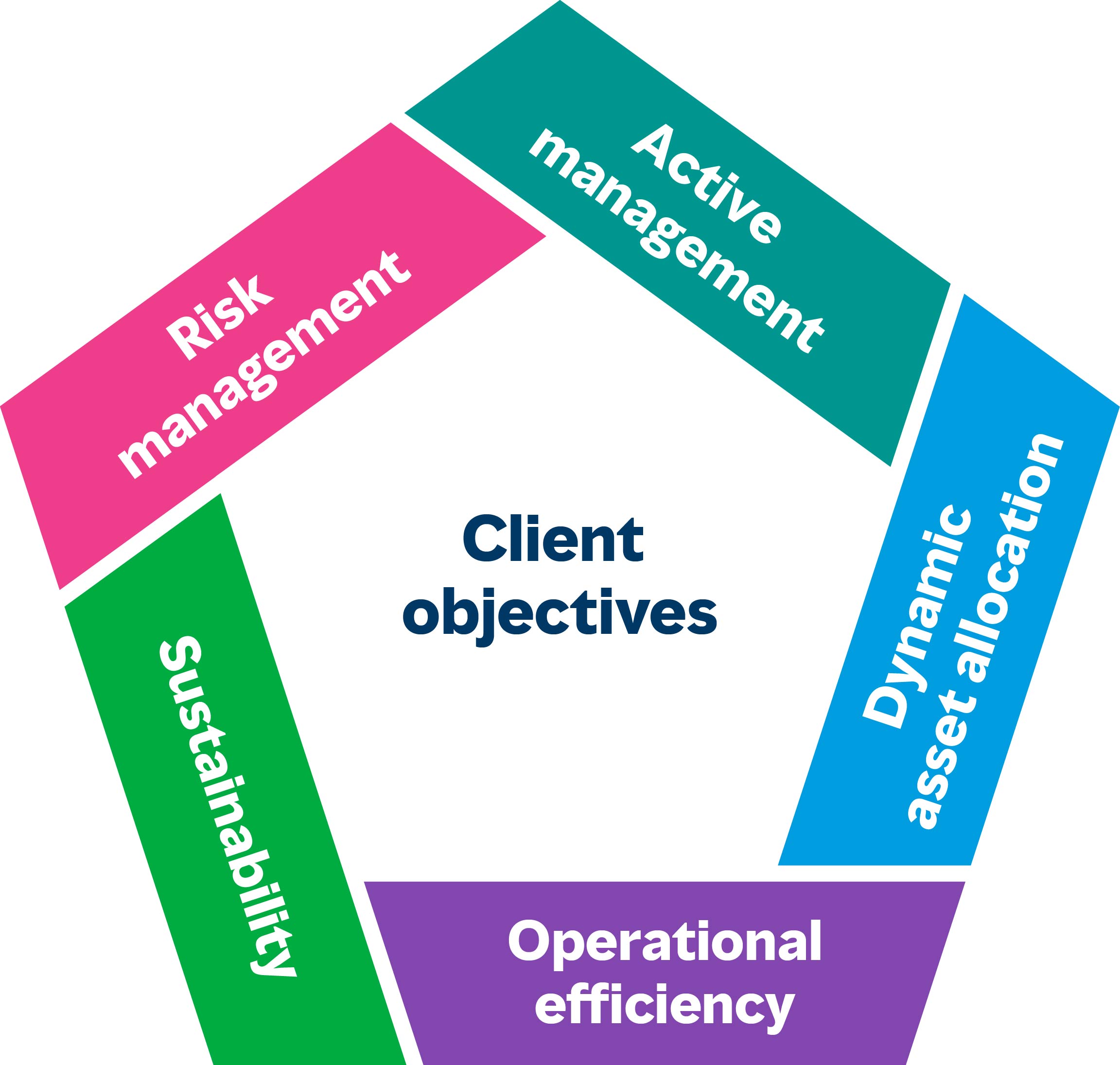

Mercer has five globally consistent investment beliefs that guide our investment process but may vary in their applicability to our solutions and advice to clients.

Our investment beliefs are:

Risk management – We believe in the merits of genuine diversification and that asset allocation is the most important decision an investor can make.

Active management – Active management is a skill and our investment manager research process can improve the likelihood of identifying skilful investment managers. We also offer a number of passively managed funds.

Dynamic asset allocation – Implementing medium-term asset allocation changes in response to changing market conditions can add value and/or mitigate risk in a portfolio.

Operational efficiency – Investment returns can be enhanced by having a monitoring and governance framework that focuses on evaluating and quantifying investment efficiency.

Sustainability – Taking a sustainable investment view may create and preserve long-term investment capital.

See the Sustainable Investment page for more details on our sustainable investment approach.

Learn more about our investment beliefs.